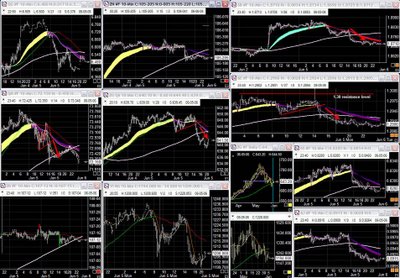

The market chopped around most of the day and broke down late. I sure missed the nice move down. There was only 1 evidence that I can see predicting this downward pressure which is shown on Addq - that creepy pattern that keeps going bleeding then drops like a rock (waterfall)...The Dow did chop all day in that bull zone but eventually gave up and the bulls didn't indicate any interest in defending it, sheesh!!

So what now? Everything is well below its ma so no longs. Nevertheless, I'm expecting the Dow to retest that zone from that underside so a bounce should be in the cards tomorrow. I'm taking tomorrow off and enjoying the long weekend. The hours weren't as bad this week.

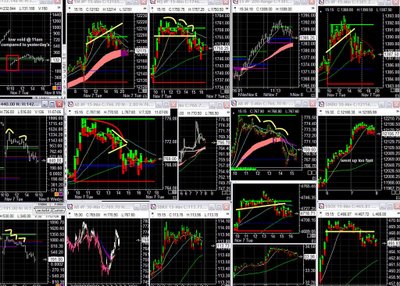

I was challenged today with Gold trades. Based on yesterday's analysis I saw a bounce to the upside so the first trade was playing that descending channel anticipating a revisit to 706 or so...got chopped around pretty good although the idea & setup were correct....the 2nd trade was the H&S neckline break and that made up for it and some more.. Euro bounced to upside as I anticipated and I went long for a nice trade, nothing big but good enough. Best trade was notes where the long setup provided a nice trade. I sure missed the move on Silver.

For tomorrow I expect Gold to hold the support line as well as Silver holding above it's 50ma. The triangle on Gold is still playable as long as 676 level holds.

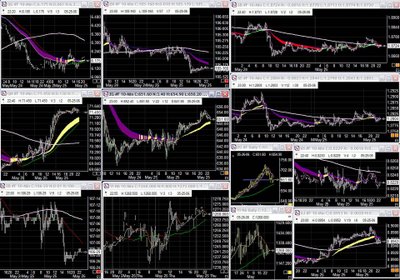

The H&S provided a long setup that I've been watching as it developed over last couple of days...yeehaawww :) (So that makes me a cowgirl???)

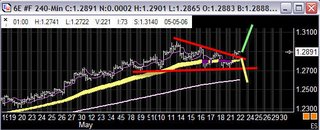

The Euro hit the underside of its major breakdown TL as I expected. Today's low was right on the neckline & today's up move was the formation of the RS on a larger H&S as indicated on 120min. Any break of today's TL signals the completion of H&S pattern and possible further breakdown if neckline is breached... something to watch for tomorrow.

I also see a consolidation and a bear flag on the Yen (10 & 120min). The patterns on currencies indicate downward movement.

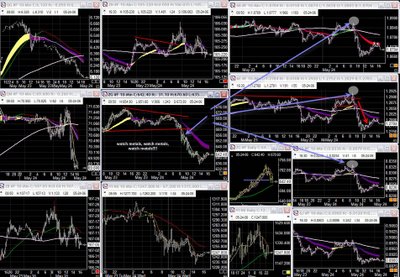

The market had one large move in the morning and that was about it for the rest of the day...yaaaawwwnnnn! Somebody wake me up when they're done with this crap hehe...

The market had one large move in the morning and that was about it for the rest of the day...yaaaawwwnnnn! Somebody wake me up when they're done with this crap hehe...