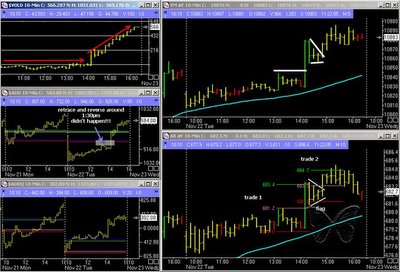

November 23, 2005: Continuation...Happy Thanksgiving!

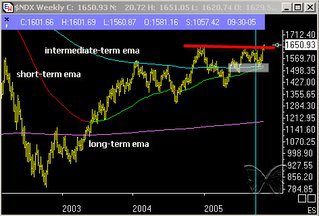

The market took off today (as expected)... happens every year, why not this one? haha.... There's no resistance on these levels that's why the sudden upsurge.. many probably are surprised but I'm not.. I mark and target levels that go back few years... and the charts are telling me 11k is key on Dow while ES has till about 1325 area and COMQ around 2300... so here..... well Friday will be thin, and I do expect a meaningful pullback and consolidation first week of December based on seasonal patterns... Me?? Busy today, and yea we're having a turkey.... yum!!!

The market took off today (as expected)... happens every year, why not this one? haha.... There's no resistance on these levels that's why the sudden upsurge.. many probably are surprised but I'm not.. I mark and target levels that go back few years... and the charts are telling me 11k is key on Dow while ES has till about 1325 area and COMQ around 2300... so here..... well Friday will be thin, and I do expect a meaningful pullback and consolidation first week of December based on seasonal patterns... Me?? Busy today, and yea we're having a turkey.... yum!!!

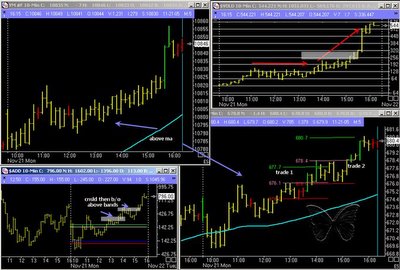

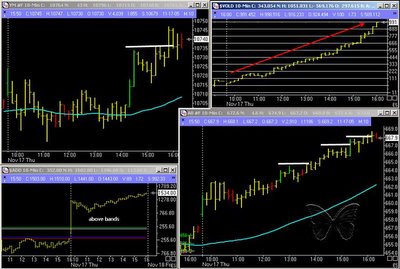

Nice setups today with no hesitation as all charts are confirming upward action... Those are the times when one gets aggressive on size, especially on trending days like the ones we're experiencing now.... No counter-trend crapola or outsmarting the market.... this is as straightforward as it gets..... :)