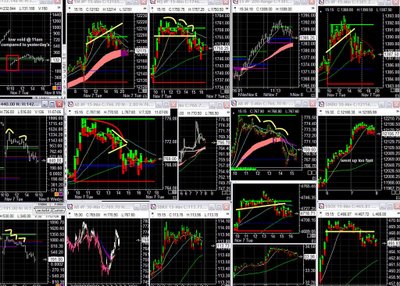

Nov. 13, 2006: Up

The market had one large move in the morning and that was about it for the rest of the day...yaaaawwwnnnn! Somebody wake me up when they're done with this crap hehe...

The market had one large move in the morning and that was about it for the rest of the day...yaaaawwwnnnn! Somebody wake me up when they're done with this crap hehe...Ok, so I expected a retracement to the upside and that took place. Now what? Well, I'm looking at the indixes for clues and the ony ones that provide any clues are Trans, Dow, and Sox. Tuesday should witness a definitive move either to the upside or downside (duh!) with very little room for consolidation. The news releases might do the trick. COMPX is up against 2400 level so is the Dow with 12200 and those aren't easy levels to take out. I'm favoring the short scenario at this point. Will confirm when the market opens.