March 31, 2006: 'Inverted N' day

Nothing much to talk about today...the market is choppy..

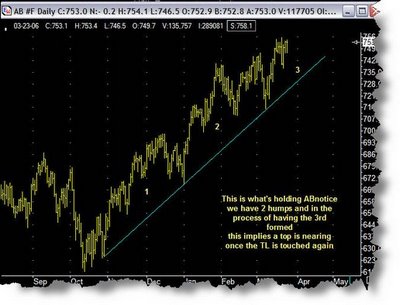

Nothing much to talk about today...the market is choppy..Notice the potential for a 'W' pattern on the YM based on 'Inverted N' pattern, other than that the Dow is still weak and certainly that 'diamond' pattern shouldn't be taken lightly.

Only hope for this market to breakout to fresh new highs is the Naz.