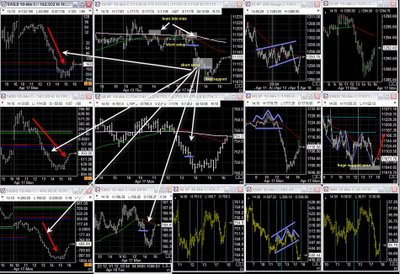

April 17, 2006: Breakdown & Retracement

Wow! what a monday! This market was definitely a mover today...plenty of trades and setups...well, let's see... as mentioned in last blog entry I expected one of the scenarios on the dow to play out which is for price to reach bottom of range (11050) and find support initiating the last leg of a 'W'... that happened after a strong selloff then a strong bounce off that level... The entire market was in sync and soldoff as well (look at all the bearish patterns).. Now let's see if tomorrow's Dow can pull off a W...breach of 11050 is considered a very bearish scenarios and confirms the multitude of topping patterns we've been seeing lately.

Wow! what a monday! This market was definitely a mover today...plenty of trades and setups...well, let's see... as mentioned in last blog entry I expected one of the scenarios on the dow to play out which is for price to reach bottom of range (11050) and find support initiating the last leg of a 'W'... that happened after a strong selloff then a strong bounce off that level... The entire market was in sync and soldoff as well (look at all the bearish patterns).. Now let's see if tomorrow's Dow can pull off a W...breach of 11050 is considered a very bearish scenarios and confirms the multitude of topping patterns we've been seeing lately.As for trades, I shorted the early break against ma on YM, then entered a long (salmon) and was able to get good points.. I did miss the other short.... oh well, no biggie....

As for commodities and notes, I entered 2 trades today on break of dbl hump patterns... the second one was better especially after fading weekly low which coincided with critical bond rates.. I missed gold & silver b/o which coincided with breakdown of other indices..

As for commodities and notes, I entered 2 trades today on break of dbl hump patterns... the second one was better especially after fading weekly low which coincided with critical bond rates.. I missed gold & silver b/o which coincided with breakdown of other indices..Other observations:

Wheat and corn correlate very well and are in sync in terms of downward action...

The patterns on gold & silver call for a pullback.. we shall see....

I have been playing around with euro in relation to other currencies such as Yen and Swiss Franc... more on that later....

In terms of the Nikkei, I put up NKD as it trades US hours but is it the correct one?? Not sure, I'll have to ask. But its action is very smooth.

0 Comments:

Post a Comment

<< Home