November 3, 2005: Hook

Ok, so today's session offered so many lessons and observations. But before that I want to highlight the market action: morning offered the follow-thru before reversing during the day and a mild retracement before close! The most important to highlight today is the action between the VOLD and ADD/ADDQ - look at the opposite directions in the morning! If that's not a warning sign, what is??? ADD opened at very high levels which meant the market needed to sustain strong upward momentum to keep it at that level, but look where the ADD wound up at the open: Below bands!!!.... and continued to do so throughout the indices advance! Add to that failed b/o's on AB and surely something isn't right!! No longs at this point and also no shorts cuz everything is still above emas and bullish... Market is still strong and I'd say it'll advance over next few weeks especially if Dow takes out 10650 level....

Ok, so today's session offered so many lessons and observations. But before that I want to highlight the market action: morning offered the follow-thru before reversing during the day and a mild retracement before close! The most important to highlight today is the action between the VOLD and ADD/ADDQ - look at the opposite directions in the morning! If that's not a warning sign, what is??? ADD opened at very high levels which meant the market needed to sustain strong upward momentum to keep it at that level, but look where the ADD wound up at the open: Below bands!!!.... and continued to do so throughout the indices advance! Add to that failed b/o's on AB and surely something isn't right!! No longs at this point and also no shorts cuz everything is still above emas and bullish... Market is still strong and I'd say it'll advance over next few weeks especially if Dow takes out 10650 level....

Few things to point out. 1) the YM pattern, and it's a bearish one...it's one of those that repeat... 2) divergence between VOLD and ADD...3) Waterfall pattern on ADD...4) failed b/o on AB 5) that short trade on AB setup is very low probability considering market strength....

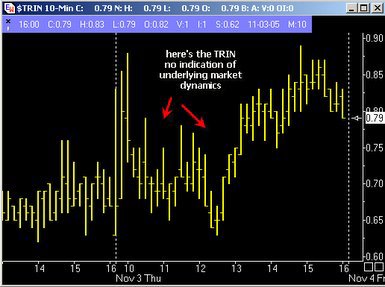

I've added the TRIN chart to show that by looking at the relationship between VOLD and ADD it gives a much clearer picture.... I think TRIN is one of those over-rated indicators out there....eh??

0 Comments:

Post a Comment

<< Home