May 2, 2006: Short-covering

This is my first day back from a break. The hours are terrible but I've been doing well after deciding to diversify. The gold/silver meltdown pattern 2 weeks ago made for a nice trade that I'd consider trade of the year so far.

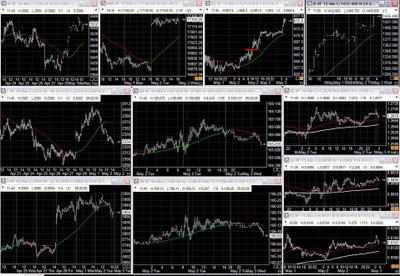

This is my first day back from a break. The hours are terrible but I've been doing well after deciding to diversify. The gold/silver meltdown pattern 2 weeks ago made for a nice trade that I'd consider trade of the year so far.Today the market was exhibiting bullish action in the morning regardless of having some of the indices like NQ below ma. I was biased to the long side all morning and went long on YM and ER. ADD clearly shows a short-covering pattern from the old days :) and VOLD was just creeping up.. All one

had to wait for is AB & YM b/o from cnsld... Kept watching NQ cuz it was holding the market, and sure enough the follow-thru was anemic cuz it couldn't clear it's ma... NQ is still king!! The semis got some nice support and that's what to watch for.

For tomorrow's session, I'd watch the arc on ES if it follows thru but more importantly the pattern on Dow - it has potential to b/o to the upside or form a 3 humper to the downside...that's easy to read and decide based on which direction it breaks...

I had 2 trades - notes and Gold... Gold had a cnsld b/o and gave a nice profit, while notes gave a little profit (as usual) but consistent... I'm happy w/both of these instruments so far and the results show it... what's up with silver quotes??? I can't seem to be getting a clean chart...what's up w/that? I haven't done extensive technical /levels analysis on gold or notes...something I still need to work on...for now it's the simple patterns.

I had 2 trades - notes and Gold... Gold had a cnsld b/o and gave a nice profit, while notes gave a little profit (as usual) but consistent... I'm happy w/both of these instruments so far and the results show it... what's up with silver quotes??? I can't seem to be getting a clean chart...what's up w/that? I haven't done extensive technical /levels analysis on gold or notes...something I still need to work on...for now it's the simple patterns.

1 Comments:

Welcome back. I couldn't open yr 2nd chart (no link to a bigger version for some reason). In electronic silver the volume seems to be in July (ZI N6), which i guess is the front month for the pit. If yr looking at june that's near zero volume and might explain the funky price action.

Thanks for stopping in FL's room yesterday, and for updating the blog.

dave_b_quick

Post a Comment

<< Home